Gas Engineers & Gas Fitters Insurance

Compare Heating & Gas Engineer Insurance

- Complete one short form

- Quickly compare quotes

- Find a great deal today!

Compare insurance quotes from UK’s leading public liability insurers including:

Why Compare Gas Engineers Insurance At SimplyQuote.co.uk?

Comparing gas engineers insurance with SimplyQuote helps you find the right protection for your trade while saving time and money.

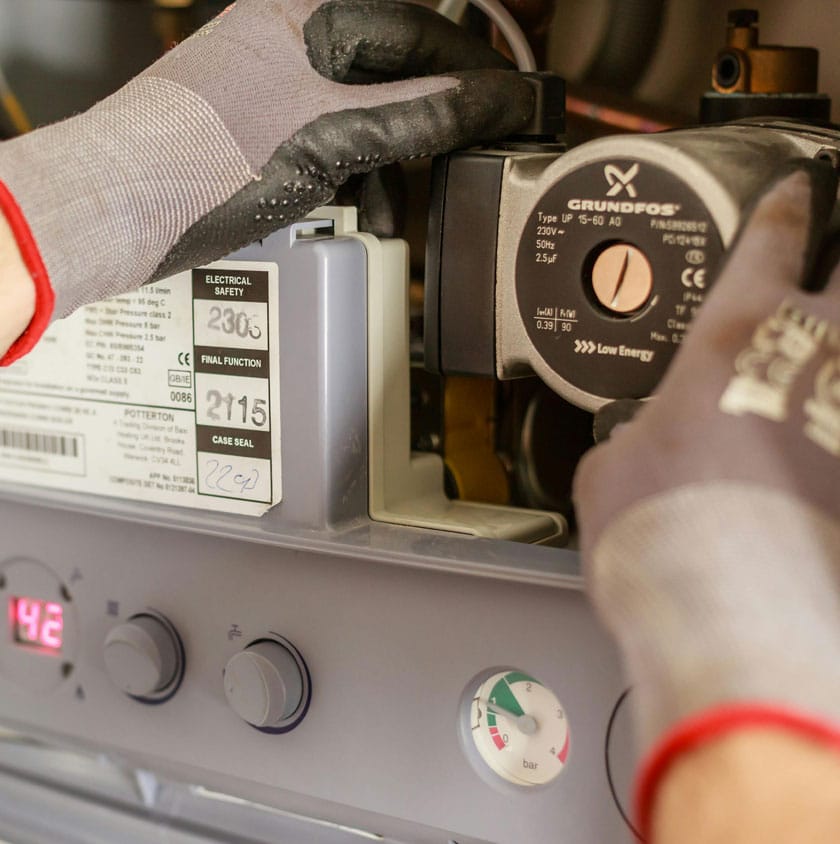

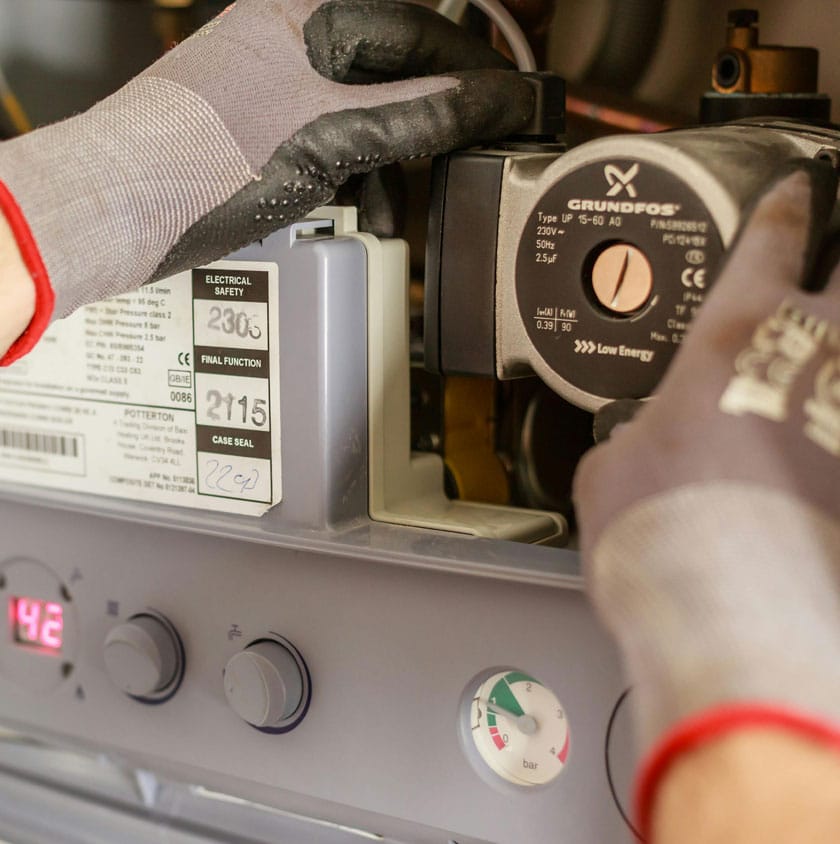

Working with gas involves risk. A single mistake could lead to injury, property damage, or even the loss of your Gas Safe registration if you’re not adequately insured. That’s why having the right level of cover is essential for anyone working as a gas engineer, installer, or heating specialist.

At SimplyQuote, we make it easy to compare multiple UK insurers in one place, helping you find policies that fit your type of work and budget. Through our partnership with Quotezone, you’ll see real-time quotes designed for gas engineers, from sole traders handling small domestic jobs to larger teams working on commercial sites.

By comparing policies side by side, you can quickly identify which offers the right balance between cost, cover, and reliability. You’ll see options for different levels of public liability insurance, typically ranging between £2 million and £10 million, giving you the confidence to take on new contracts knowing you’re properly protected.

SimplyQuote simplifies the process so you can stay focused on what matters: running your business safely, staying compliant, and protecting your reputation on every job.

What Do I Need to Get a Quote?

To get a gas engineers insurance quote, you’ll need to provide some basic details about your trade, business setup, and the cover you need.

The process is quick, usually taking less than five minutes, and helps insurers tailor quotes to your exact line of work. The more accurate your information, the more reliable your results will be.

You’ll typically be asked for:

- Your Gas Safe registration number

- The type of work you carry out (for example, installation, servicing, or emergency repair)

- Whether you’re self-employed or operate a small team

- Your business postcode

- Your annual turnover

- The level of public liability cover you want (£2 million, £5 million, or £10 million)

- Whether you want to include tools, equipment, or employers’ liability

- Details of any past claims or incidents

This information allows insurers to assess your risk accurately. A self-employed engineer handling domestic boiler servicing will have different requirements to a team working on commercial heating systems.

By completing the form once, you’ll receive multiple quotes tailored to your business. Each one shows cover levels, exclusions, and pricing clearly, helping you make a confident, informed decision without unnecessary back-and-forth.

Do Gas Engineers Need Public Liability Insurance?

While public liability insurance isn’t a legal requirement for gas engineers, it’s one of the most important types of cover you can have.

Gas engineers work in high-risk environments where accidents can have serious consequences. Even small mistakes, like a damaged pipe or a minor gas leak, can lead to injury, property damage, or costly claims. Public liability insurance protects you against these risks by covering compensation and legal costs if a member of the public, a client, or a third party is injured or their property is damaged due to your work.

Although it’s not mandatory by law, most clients, letting agents, and local authorities will require you to have proof of public liability insurance before you start work. In fact, some trade contracts or commercial site jobs won’t allow you on-site without it.

For example, if a gas engineer accidentally causes a carbon monoxide leak while fitting a new boiler, or damages a customer’s kitchen during installation, the costs can quickly escalate into thousands of pounds. Without insurance, you would have to pay those costs personally.

Having the right policy in place ensures your business and reputation are protected, giving you the confidence to take on more work knowing that you’re covered for the unexpected.

What Does Gas Engineers Insurance Cover Include?

Gas engineers insurance is designed to protect you from the most common risks that come with working in people’s homes or on-site.

A standard policy typically includes public liability insurance, which covers injury or property damage caused by your work. This is the foundation of most gas engineers’ policies, protecting you if a customer, member of the public, or another contractor makes a claim against you.

For those employing others, employers’ liability insurance is a legal requirement and protects your business if an employee becomes injured or ill as a result of their work. Most insurers offer at least £10 million in employers’ liability cover.

Many gas engineers also choose to include tools and equipment cover, ensuring they’re not left out of pocket if essential items are stolen or damaged. Other optional add-ons can include professional indemnity, covering you if advice or design work you provide leads to a claim, and personal accident cover to support income if you’re unable to work following an injury.

Example cover options can include:

| Type of Cover | What It Protects Against | Typical Limit |

|---|---|---|

| Public Liability | Damage or injury to others | £2m – £10m |

| Employers’ Liability | Employee injury or illness | £10m |

| Tools & Equipment | Theft or damage to tools | Up to £10k |

| Professional Indemnity | Errors in design or advice | £100k – £1m |

| Personal Accident | Loss of income after injury | Varies by policy |

Having the right combination of cover ensures your business stays protected from every angle, from accidental damage to costly legal claims.

What’s Not Covered?

Gas engineers insurance protects against many of the risks you face daily, but it doesn’t cover everything.

Knowing what’s excluded is just as important as knowing what’s included. Every policy has limits to ensure fairness and prevent misuse, and understanding them before you buy helps you avoid gaps in protection.

Most standard gas engineer policies won’t cover:

- Faulty workmanship: if you complete a job incorrectly, your insurer may cover the resulting damage (for instance, a leak) but not the cost of redoing the work itself.

- Deliberate or criminal acts: any claim resulting from illegal activity, deliberate damage, or negligence will be rejected.

- Damage to your own property or tools@ you’ll need a separate tools or equipment insurance policy for this.

- Injury to yourself or your employees: this is only covered if you have employers’ liability insurance in place.

- Professional mistakes or bad advice: covered separately under professional indemnity insurance.

- Wear and tear: insurers won’t pay for gradual deterioration, corrosion, or mechanical failure of equipment.

For example, if a faulty boiler installation causes water damage to a customer’s floor, the insurer may cover the floor repairs but not the cost of reinstalling the boiler. Similarly, if your van is broken into and your tools are stolen, that would only be covered if you’ve added tool cover to your policy.

Before purchasing, always review the policy wording and exclusions list carefully. Some providers may also limit the type of work or height you can operate at, so if you’re involved in commercial or industrial gas work, it’s essential to check those details first.

How Much Does Gas Engineers Insurance Cost?

Gas engineers insurance typically costs between £90 and £250 per year for public liability cover, depending on your work type, location, and level of protection.

The exact cost varies from one business to another. A sole trader carrying out domestic boiler installations will pay less than a team handling larger commercial contracts. Adding extra cover such as tools, employers’ liability, or professional indemnity will also increase the total premium.

Several key factors affect how much you’ll pay for gas engineers insurance:

- Type of work: Servicing and maintenance work is lower risk than commercial or industrial projects.

- Level of cover: Most policies offer between £2 million and £10 million of public liability protection. Higher limits increase premiums but are often required for commercial jobs.

- Business structure: A self-employed engineer pays less than a company with multiple employees or subcontractors.

- Claims history: Clean records lead to lower premiums and better renewal rates.

- Payment method: Paying annually can save around 10–15 percent compared to monthly instalments.

As a guide, a self-employed gas engineer working on domestic systems might pay about £100 a year, while a small heating business with several engineers could pay around £350–£450 annually for full cover.

Understanding these cost drivers helps you find the right balance between protection and price when comparing policies.

Related Read: How Much Does Public Liability Insurance Cost In The UK?

How Can Gas Engineers Save Money on Insurance?

Gas engineers can reduce their insurance costs by comparing quotes, maintaining a good claims history, and choosing only the cover they genuinely need.

Most insurers price policies based on perceived risk, so anything that shows you’re a careful, low-risk tradesperson will help bring premiums down. The simplest way to save is to compare multiple quotes online through SimplyQuote. Price differences between providers can easily exceed 25% for the same level of protection.

You can also make small but effective adjustments:

- Pay annually instead of monthly: A £100 annual premium could cost around £120 when paid in instalments because of interest and admin fees.

- Review your cover regularly: Self-employed engineers should avoid paying for employers’ liability if they don’t hire staff.

- Increase your voluntary excess: Opting for a slightly higher excess can lower your premium, as long as it’s affordable if you claim.

- Secure your tools and van: Insurers may offer better rates if you have alarms, tracking devices, or store tools safely overnight.

- Stay Gas Safe registered and compliant: Proof of qualifications and risk management can demonstrate professionalism and reliability.

A disciplined approach to safety, compliance, and quote comparison not only protects your livelihood but ensures you’re getting the best possible value from your insurer.

How To Compare Gas Engineers Insurance Quotes At SimplyQuote

Comparing gas engineers insurance quotes with SimplyQuote is fast, straightforward, and completely online.

As a dedicated comparison platform for tradespeople, SimplyQuote makes it easy to view live prices and cover options from multiple UK insurers in one place. You’ll see transparent policy details designed for gas engineers and heating professionals, helping you find the right balance between cost and protection.

Here’s how it works:

- Enter your business details: Tell us about your work, whether you’re self-employed or run a small team, and your business postcode.

- Select the cover you need: Choose from public liability, tools and equipment, employers’ liability, and other optional add-ons.

- View your quotes instantly: Powered by our partnership with Quotezone, you’ll see multiple insurers side by side within minutes.

- Compare and filter: Review policy limits, excesses, and extras such as £2 million, £5 million, or £10 million liability levels.

- Choose and apply: Once you’ve found the right policy, complete your application directly with the insurer quickly and securely.

There’s no obligation to buy and no hidden fees. Whether you’re fitting boilers, repairing gas lines, or managing a small heating business, SimplyQuote helps you make an informed choice in just a few minutes.

Frequently Asked Questions

Yes. Public liability insurance protects you if your work causes injury or property damage. It’s not legally required, but most clients, landlords, and local authorities expect it before allowing gas engineers on-site.

Most gas engineers choose between £2 million and £5 million of cover. Commercial contractors or local authority work may require up to £10 million.

Public liability isn’t mandatory by law, but employers’ liability insurance is legally required if you employ staff, even part-time.

No. It typically covers resulting damage (for example, water damage from a faulty boiler), but not the cost of redoing the work itself.

Not automatically. You’ll need to add tools and equipment cover to protect against theft, loss, or accidental damage.

Yes. Some insurers offer flexible or project-based policies for short-term work or contract jobs lasting a few weeks.

Most policies cover typical domestic and light commercial work, but check your insurer’s terms for height restrictions if you regularly work above two storeys.

Compare multiple quotes, pay annually to avoid interest, maintain a clean claims record, and follow safety best practices to demonstrate lower risk to insurers.

Public Liability Insurance Guides